Russian collection agencies summed up the results of 2018

BBC Russian, 24.04.2019, The Russians get into debt, collectors are full of optimism: “Dawn has come”.

On April 24 2018, was held the conference of National Association of Professional Collection Agencies (NAPCA) of Russia where representatives of the professional community summed up the results of 2018 and discussed the trends in the industry development this year.

There was almost an ideal situation for the collectors: the credit load on Russians is growing, but the income of the population is declining some years in a row. According to the National Association of Professional Collection Agencies (NAPCA) in 2018, the number of new cases transferred to collection agencies increased by almost a third – to 6.4 mln. It’s for the first time since 2015.

Collection agencies receive debt cases of people who do not return money to banks or microfinance organizations in two main ways:

1. Cession: the volume of proposals in this market is estimated at 470 bln rubles ($7.3 bln);

2. Agency-based services: the volume of such transactions has increased in 2018 for the first time since 2015. In-all collectors received 6.4 mln new debt cases in total amount of 505 bln rub ($7.8 bln). In 2017, they have had 5.3 mln debt cases.

“In 2018, within the framework of Agency-based services, collectors have returned to banks about 16 bln rub ($247 mln),” – said the analyst of NAPCA.

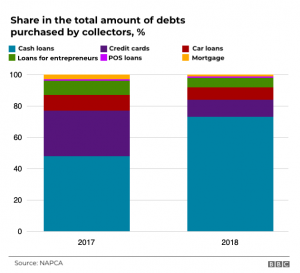

Types of “bad” loans

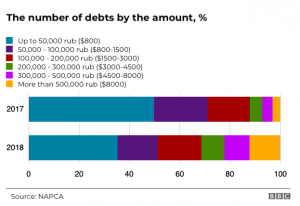

The average amount of overdue debt per person increased from 73.6 thousand rubles in 2017 to 79.4 thousand rubles.

What debts collectors have bought from banks

Elman Mekhtiev, the Head of NAPCA, is confident that in the coming years will grow as original debts, and resale. He explains this not only by the growth of lending, but also by the weak dynamics of income of the population and the increase in the efficiency of the collectors themselves. Real disposable income in Russia did not grow from 2014 to 2017. At the end of 2018, firstly, Rosstat reported about the fall of this indicator by 0.2%, but then recalculated it. It turned out that the income, however symbolically, but increased by 0.1%. According to the latest data of Rosstat, the income of Russians has decreased by 8.3% since 2013.

Trends of the market development:

– In the future, collectors expect that the Russians will allow delays in mortgage loans. Last year there was a mortgage boom in Russia: banks issued more than 3 trln rubles of mortgage (46.5 bln dollars). The Head of NAPCA believes that the part of the mortgage debts will also be overdue. He associates this situation with the issuance of loans for a small down-payment. “If the down-payment is less than 30%, then in the conditions of the economic turbulence, much more people fall into debts,” he told to the BBC.

– Collection market was changed by the law in 2016, which restricts the activities of agencies. The law prohibits collectors to communicate with the family and neighbors of the debtor without his/her permission, as well as limits the number of calls and personal meetings. But the rules are not the same for everyone. In practice, banks and MFOs often fall out of regulation and may themselves try to withdraw debts. Fedor Vahata, CEO of Russian branch of MBA Consult Group, noted that there are so-called “gray collection agencies” that operate without any license and with whom the regulator can do nothing.

Another consequence of the law was a sharp increase in the number of lawsuits: judicial recovery is developing rapidly and becomes one of the important directions in the development of the collection business of the country.

– CEO of M.B.A. Finance believes that another opportunity for the growth – debt collection in the utilities sector. “This segment of the market is not yet so much covered by the professional collection companies, while the amount of debts in this area is simply enormous.” The only obstacle would be the law which will ban the recovery at the Utilities.

– At NAPCA believe that the market will partially grow due to the increase in the efficiency of the agencies themselves. “Now any collection agency can clearly explain to you when and what client you need to call. That is, not a not a massive attack of calls, but they know when they should make a call to different clients – in five days, in three, or there is no need to call at all,” – said the Head of the Association.

Agencies are becoming more and more automated: robotic collectors and the introduction of speech Analytics, the use of Big Data tools and much more. In the age of digital transformation, collection companies do not lag behind the market trends and constantly automate workflows, introduce new technologies and even offer their solutions to the market.